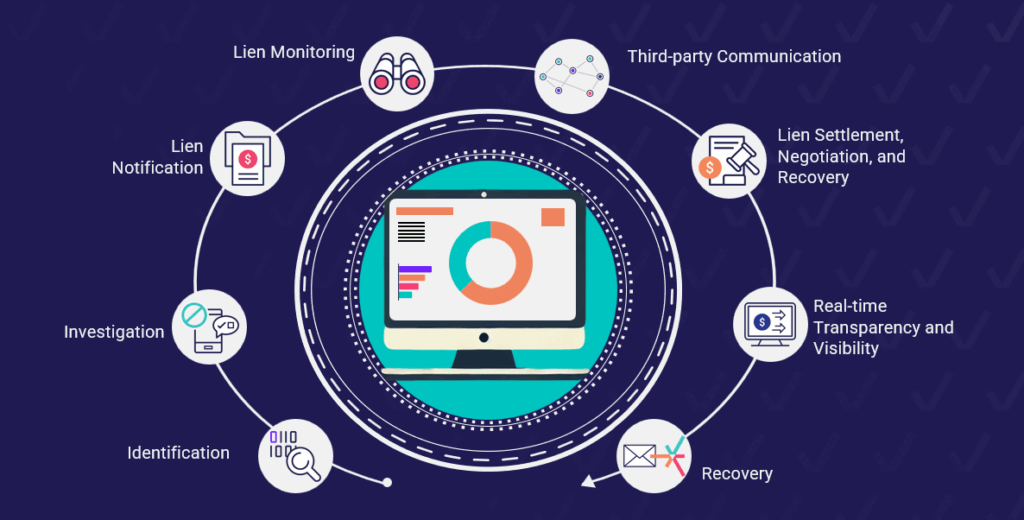

The Subrogation Process: A Step-by-Step Guide

Once triggered by an injury-related medical claim, the subrogation process involves a gauntlet of administrative and legal steps, typically spanning about 18 months from the date of an injury or accident all the way to settlement of funds. The process starts with identification and proceeds all the way to settlement and recovery reconciliation.

Step 1. Identification: Flag All Reimbursable Claims in Real Time

The first and most essential step is to identify all potential claims that could be eligible for reimbursement, ideally without relying on questionnaires asking members for more information about the cause of an injury.

A modern, tech-enabled subrogation solution will continuously crawl all paid claims, cross-referencing public and private databases to find all eligible claims in real time, not just those with obvious ICD codes for motor vehicle accidents or workers comp-related injuries.

Step 2. Investigation: Locate Alternative Policies with No Member Disruption

Once claims are flagged as potential subrogation opportunities, the next step is to identify all alternative insurance policies that can be tapped for reimbursement. At this stage of the process, it is important to investigate all cases, regardless of the dollar amount, and collect supporting documentation.

It also means confirming policy, adjuster, and attorney information. Access to external data sources such as police reports and legal filings significantly improves accuracy and efficiency.

Step 3. Lien Notification: Notify Parties When Liens Are Issued

Next, the health plan must put the alternative policy on notice of the lien for repayment. Timely lien notification is critical, as delays can result in missed recoveries. The goal is to issue such lien notices within hours, not weeks or even months, as is sometimes the case if identification depends on member responses.

Tech-enabled subrogation solutions can automatically confirm case details and issue liens to the appropriate party or parties without delay — all without contacting plan members.

Step 4. Lien Monitoring: Compile Accurate and Full Lien Value

After issuing the lien and confirming that the alternative policy has received it and verified the availability of funds, it’s critical to continuously monitor and update the growing lien, which will account for all paid claims associated with the injury. For example, beyond immediate treatment in an ER, serious injuries may result in numerous paid claims over time, including ongoing treatments for physical therapy or non-obvious complications.

Aggregating all claims associated with an accident or injury is known as capturing the full episode of care. Once treatment is completed and all claims are accounted for, the lien total is finalized.

Step 5. Third-party Communication: Coordinate with Attorneys and Insurers

Throughout the subrogation process, there is often a lot of back-and-forth with the other parties involved, including attorneys and insurance companies. It’s critical to stay on top of notices and communications from all parties and to provide an immediate response to requests for information. Failure to do so could mean delaying or halting the process. Such communications involve:

- Confirming and documenting that all policies have received the lien.

- Connecting with counter parties to obtain maximum reimbursement.

- Responding to legal and document requests.

Step 6. Lien Settlement, Negotiation, and Recovery: Maximizing Reimbursement Amounts

In many cases, the lien settlement and negotiation step involves dealing with attorneys representing the injured party or adjusters to reach a settlement regarding the division of available funds. This will occur if the amount of funds available will not cover all reimbursement to all parties.

Health plans or vendors may find themselves at a disadvantage if they don’t have the legal or negotiation skills during this stage. A guided framework based on best practices can help case managers and subrogation teams negotiate with confidence and build a strong, defensible case.

Step 7. Real-time Transparency and Visibility: The Ability to Track Cases

Transparency and visibility of individual case progress is an area where traditional subrogation has lagged, often leaving plan administrators in the dark without clear reporting and unaware of case statuses or outcomes. More recent subrogation solutions feature client portals and related digital platforms to enhance transparency and accountability, providing real-time updates and comprehensive case histories.

With automated notifications and alerts, critical deadlines and actions are never overlooked, and decision-makers are always equipped with the latest, most relevant information, including a realistic view of anticipated reimbursements.

More Resources from Intellivo

Recover More. Stress Less. Let’s Talk.

Subrogation doesn’t have to mean disruption. Intellivo delivers better results — for your plan, your team, and your members